Introduction

The Italian Tax Agency has been carrying out an intense audit activity on a significant number of yachts that have carried out charters started in Italy during the period 2017/2020. The scope of the audits is to reclaim the VAT balance that should have been paid by the yacht owners on charters started in Italy and carried out in the European Community waters. The audits are currently causing serious problems to yacht owners that are potentially liable to pay large amounts of money as VAT balance, interest since 2017 and penalties.

This brief article is to provide the reader with a brief analysis of the Italian legal framework concerning the application of VAT on charters. We will also quickly address some of the main topics that yacht owners should consider if faced with a tax audit on yacht charters.

Legal Framework

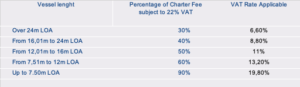

Pursuant to the 2006/112/EC Directive (the “VAT Directive”), the place of supply that is relevant for VAT taxability of short-term charter services of a means of transport (ie. a yacht) is the one where the vessel is delivered to the charterer. The VAT Directive allows Member States to opt for the criterion of the place of actual use of the service in Community waters, in order to prevent cases of VAT double taxation. This option was introduced in Italy by law no 342/2000. Starting from November 2000, an alternative method for the application of VAT, based on the so-called “flat rates” was introduced by the Italian Ministry of Finance alongside the “actual use” criterion, aimed at resolving the problems with proving the use of a yacht outside EU territorial waters. The Italian Revenue Agency (Agenzia delle Entrate, “AE”) with the Circular No. 76/2001, introduced for the first time the “flat rates” according to which the use of a vessel in international waters is assumed on the basis of the length of the vessel[1].

However, from the interpretation of the applicable law provisions and of the Circular of the Revenue Agency, the flat-rate calculation method in no way excluded the application of the criterion of the actual use of the yacht in international waters. In 2018 the European Commission started infringement proceedings against Italy (as well as against Malta, Cyprus, Greece, UK). In essence, the Commission pointed out that a general VAT flat-rate reduction solely on the basis of assumptions was not acceptable. As a result of the infringement procedure, as of November 1, 2020 Italy abolished the regime of “flat rates” waters and it introduced the regime of actual navigation in international waters. Pursuant to the Italian tax authorities, most of the large vessels (ie. those having a length equal to or more than 24 meters for which the applicable VAT flat rate would have been of 30% of 22%, ie 6,6 %) are equipped with AIS tracking system and are able to prove at all times the actual and navigation in international waters.

VAT audits on yachts’ charters carried out in the period 2017/2020

The Italian Tax Agency has been conducting investigations on yacht owning entities regarding the VAT charged on charter fees in relation to charter contracts started in Italy before November 1, 2020 (namely during the period 2017/2020). The Tax Agency argues that the use of the “flat-rate” reduction of the tax base is allowed only in the event that actual navigation in non-EU waters could not be proven otherwise.

The Tax Agency reconstructed the charter routes of the vessels being audited in non-EU-waters by using routes tracked by on-board AIS systems. Therefore, the Tax Agency recalculated the VAT balance due in relation to navigation in Italian waters, applied interest, penalties. In some cases, criminal sanctions would apply to the directors of the owning entities.

Possible grounds for defense and negotiation with TA

The audits reports of the Tax Agency can be challenged in several respects. For example, prior to November 1, 2020, no Italian rule explicitly stated how the proportion of navigation in Italian waters was to be determined with respect to the one performed in non-EU waters, i.e. whether on the basis of miles travelled or on the basis of time spent. Therefore, whichever criterion the Tax Agency used in auditing the yacht owners could be considered arbitrary. Secondly, irrespective of the criterion used, the Tax Agency may have made material errors in the calculation of the charter routes (also due to the absence of the AIS signal during navigation), so that it may be advantageous to challenge the reconstruction of the charter voyages carried out by the yacht owner entity.

Risks

In the event that an agreement cannot be reached with the Tax Agency or in the event a tax court rules against the tax payer who has challenged the assessment of the tax authorities, the yacht owning entity risks having to pay the increased VAT assessed, plus 4% annual interest, plus 90 per cent of the VAT assessed as a penalty, as well as a possible indictment of the director for tax offences.

It is therefore essential that yacht owners that have been subject to the audits of the Italian Tax Agency are assisted by expert Italian tax lawyers and advisors in this very delicate situation.

—

[1]According to this Circular the taxpayers could determine at a flat rate the time of use of the vessel outside Community territorial waters, complying, for the purposes of determining the VAT taxable amount, the percentages listed below, distinguished according to the category to which the vessel belongs (motor yachts category)